We’ve reviewed 300+ financial planners and advisers in Melbourne and ranked the best ones for you. In this article, we’ll share with you some of the city’s most trusted and knowledgeable financial experts.

Most of us want financial freedom. A recent study says that 55% of Australians say it’s one of their primary life goals. But simply making more money and keeping as much of it as you can in your bank accounts is not enough to achieve wealth and success.

What you need are the right financial strategies, tools, and investment opportunities to grow your wealth. That way, you and your family can enjoy freedom from financial worries for the better portion of your financial life. And all that starts with finding the right financial planner.

What is a Financial Planner?

So what is a financial planner and what do they do They’re professionals who help clients develop and achieve long-term financial goals. They can work in various industries, including banking, brokerage, and insurance. Some of them hold other titles such as financial advisor, wealth manager, or financial consultant.

Generally speaking, a good financial adviser can help you with three things:

- Investment advice: Advising on investment options and asset allocation based on risk tolerance and time horizon.

- Insurance planning: Helping you understand how much insurance you need to get the best coverage at the lowest premium.

- Estate and tax planning: Helping you with your estate and tax planning to lower your taxes and grow your estate.

Check out our top 5 options:

| Financial Advisory Firm | Key Strengths | Specialisations | Awards & Recognition |

|---|---|---|---|

| Inovayt Finance | Simple, flexible, and solutions-driven financial planning | Superannuation, money management, retirement planning, investment advice | Top 25 Broker Awards, AFG Excellence Awards, Better Business Awards |

| Northeast Wealth | Committed to sustainable investing, specialising in ethical investments | Superannuation, retirement planning, tax minimisation, ethical investments, budgeting | Recognised for strong client relationships and financial results |

| Ariston Group | Boutique financial advice with a focus on personal relationships | Superannuation, investment, wealth protection, estate planning, lifestyle planning | 25+ years of experience, complimentary discovery consultation |

| Wealth Investors | Evidence-based investment approach, strong client-centric process | Cashflow modelling, investment solutions, retirement planning, tax optimisation | Director Chris Youssef is highly regarded in the industry |

| Verse Wealth | Holistic advice focusing on long-term, personalised financial goals | Strategy, investing, retirement planning, tax, trusts, insurance, estate planning | 2023 Financial Adviser of the Year, multiple awards for client outcomes and innovation |

We have more options with more details below, so keep reading!

The Need for More Financial Guidance

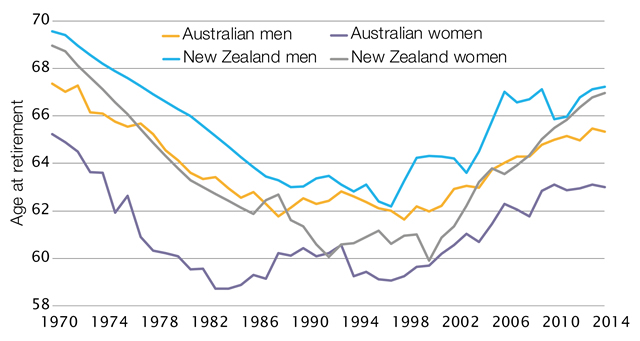

One of the main reasons why we want to store and grow wealth is to retire as early as possible. While that remains the goal for many Australians— even in Melbourne— we’re not hitting that goal.

A study showed that the retirement age in Australia has been on a steady incline in the retirement age in Australia since the late 80s.

Most of this has to do with rising costs and stagnating wages. But even as these uncontrollable factors plague Australians and their finances, there are ways to strategically prepare for retirement. The help of financial planners plays a major role in this. With the right guidance, we can retire earlier and prepare for a much better quality of life by the time we hit our golden years.

How We Chose the Melbourne Financial Planners on This List

We used these criteria to rank the best Melbourne financial planners:

1) Years of Experience

The number of years a financial planner has been in practice often reflects their expertise and reliability. Established planners are more likely to have successfully guided clients through a variety of financial challenges.

2) Client Reviews and Testimonials

High ratings and positive testimonials from Australian clients highlight a planner’s ability to deliver value and build trust. Consistent praise from satisfied clients tend to speak volumes about their professionalism and results.

3) Professional Qualifications and Memberships

Financial planners with recognised credentials, such as Certified Financial Planner (CFP®), and membership in reputable organisations demonstrate their dedication to maintaining high industry standards and staying up-to-date with regulations.

4) Transparent Fee Structures

A planner who provides clear, upfront details about fees ensures there are no surprises for clients. Transparency around costs fosters trust and helps clients make informed decisions.

5) Diverse Service Offerings

Planners who offer a wide range of services (i.e. superannuation advice, investment strategies, and retirement planning) are better equipped to meet the varying needs of Australian clients.

The 11 Best Financial Planners and Advisors in Melbourne

To reach your financial goals, you need to have an independent financial adviser to guide and guard your best interests and protect your financial future. Fortunately, there is no shortage of excellent financial planners. So here are the top ten financial planners and advisors Melbourne has to offer.

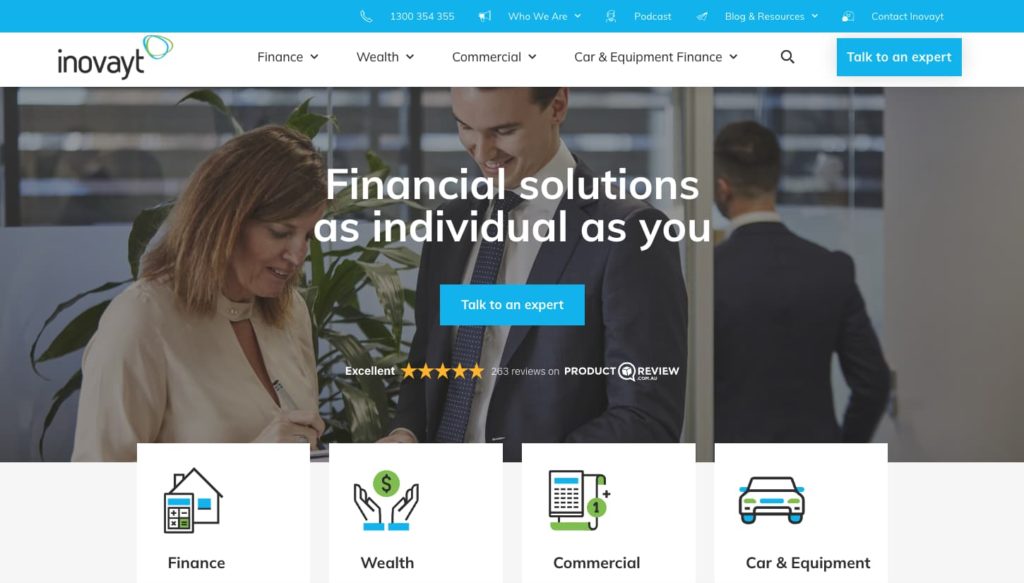

1. Inovayt Finance

Key Highlights: Simple, flexible, and solutions-driven financial planning with award-winning recognition and a strong wealth management focus.

Since 2007, Inovayt has become a reliable resource and service provider for anyone who wants to win on their financial journey. The financial advisor and mortgage broker company’s mission is to provide people with lifetime financial solutions that will bring them the best life and allow them to pursue the things that matter most to them.

Through their wealth management arm, Inovayt Wealth, the firm’s financial advisor Melbourne team can assist clients with all things pertaining to superannuation funds, money management, retirement planning, estate planning, investment advice, and more. Their approach to financial planning has been lauded for being simple, flexible, and solutions-driven for all their clients.

Inovayt is also the recipient of many well-respected awards from institutions and festivals, such as The Advisor Better Business Awards, The Advisor Top 25 Broker Awards, and AFG Excellence Awards, to name a few. To work with Inovayt’s team of wealth managers, get in touch with them today.

Inovayt also has a financial advisor Geelong team available to assist you servicing the entire state of Victoria.

On top of financial planning, the company also has mortgage broker Melbourne services as well as home loan brokering for personal loans, business loans, car loans, and more.

Address: 201/55 Walsh St, West Melbourne VIC 3003, Australia

Phone Number: 1300 354 355

Website: inovayt.com.au

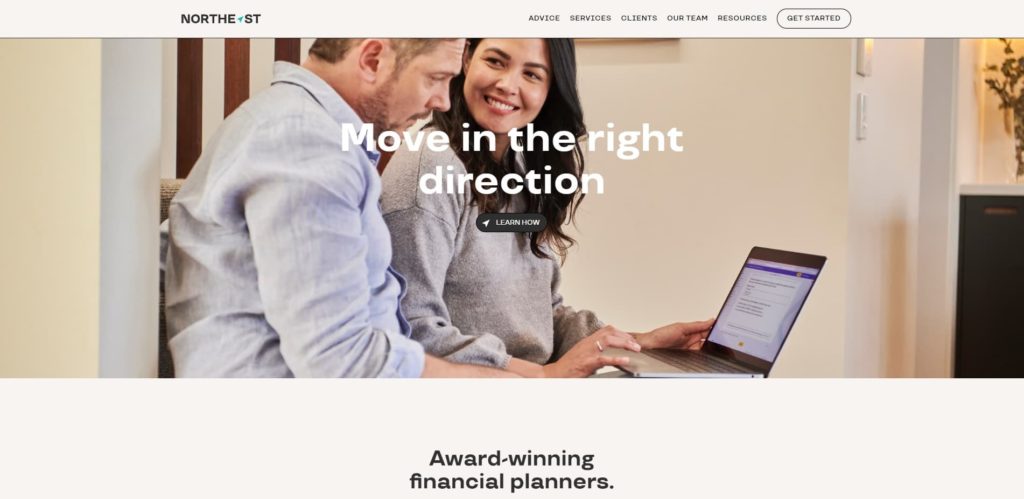

2. Northeast Wealth

Key Highlights: Specialists in sustainable investing, tailored advice for professionals, and long-term client relationships with responsive service.

Northeast Wealth are an inspired team of some of the best financial advisors focused on helping people succeed with their money and live their best lives.

They advise ambitious professionals, business owners, pre-retirees and high achievers to get clear on their strategic direction and make more financial progress. They are specialists in areas such as superannuation and SMSFs, retirement planning, tax minimisation, ethical investments, budgeting / cash flow and employee share schemes.

Northeast are one of the very few advisory firms that have made a clear commitment to 100% sustainable investing, with all recommended investments needing to achieve strict ESG ratings (Environment, Sustainability and Governance). This approach is better for our planet, and independently demonstrated to deliver stronger financial outcomes over the long-term.

“The team has been incredibly responsive and transparent, keeping us on target to meet our goals amongst a busy life full of other distractions (thanks for the gentle prompt when required :)).” – Sam

“It’s been great to see a dynamic shift in the way we view our money and how we can still maintain a certain lifestyle but with a more structured approach.” – Luke

“My fiancée and I have been able to realign all of our financial goals, and achieve incredible results in a timeframe we didn’t think was possible.” – Jack

“I have tried other financial advisers but I haven’t come across anyone who builds as good a rapport with their members as Northeast Wealth do. I trust them dearly with my finances. Thanks team” – Tri

Get in touch with their team to learn more, or for a no-obligation meeting.

Phone: 1300 304 314

Email: contact@northeastwealth.com.au

Locations: Chadstone, Richmond, Scoresby, Ringwood

Website: www.northeastwealth.com.au

3. Ariston Group

Key Highlights: 25+ years of experience providing boutique, high-quality advice with personalised financial planning and cutting-edge technology.

Financial planning firms like Ariston Group should surely make it to lists like this. Their clients have noted their sound knowledge of financial strategy and products, excellent client service, very transparent processes, high-quality advice, and among many other strong suits.

The company is led by Robert Anthony, who founded Ariston Group with the mission of making boutique financial advice available to more Australians. He has over 25 years of experience in financial services. Moreover, his passion for helping clients is evident upfront and is translated into sound financial planning strategy in the way he works with clients throughout the journey.

Ariston Group also provides a complimentary initial discovery consultation to anyone who would like to learn discuss their goals and learn more about the financial services on offer. After that, the team at Ariston Group will provide you customised plan and targeted solutions and advice to help you protect and grow your wealth. Ariston also utilises the latest first-class technology platforms to make your financial planning more streamlined and secure. With financial planners like Ariston Group, you’ll likely get a long-term relationship — which should be the gold standard for any financial planning firm.

Ariston Group can help you with the following:

- Financial advice and planning

- Superannuation

- Investment

- Wealth Protection

- Estate Planning

- Lifestyle Planning

- And many other financial planning services

Address: Level 27, 101 Collins Street, Melbourne, Victoria 3000

Website: aristongroup.com.au

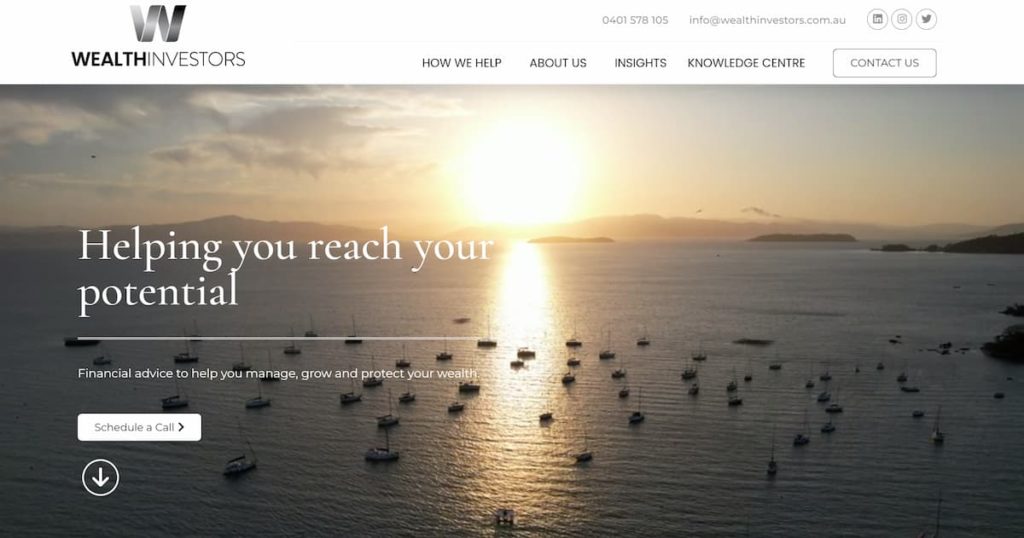

4. Wealth Investors

Key Highlights: Evidence-based investment approach, client-centric financial advice, and specialisation in wealth transfer and asset protection.

Wealth Investors is one of our favourite advice firms as they utilise an evidence-based investment approach that is backed by decades of empirical research. Unlike most firms where you could end up with a broad range of advisers with varying levels of experience and qualifications, at Wealth Investors, all clients are personally looked after by their director Chris Youssef who is one of the best in the industry.

They are a comprehensive advisory firm that specialise in all aspects of wealth. Their services include cashflow modeling, investment solutions, planning for retirement, intergenerational wealth transfer, tax optimisation, asset protection, estate planning, debt management, and personal risk protection.

Utilising a strong client-centric process, they start by understanding what’s important to you and utilise their expertise to provide you with financial advice. Their aim is to be part of your life journey and build a genuine long-term relationship with you and your family. Their focus is on advice, they aren’t interested in “selling” products. They will simplify your financial life to provide you with peace of mind and allow you to focus on the things that are more important than money.

Don’t take our word for it, have a read of the testimonials and give them a quick call for a free consultation.

Phone: (03) 9001 0467

Email: info@wealthinvestors.com.au

Location: Level 9, 477 Collins St Melbourne, VIC 3000

Website: www.wealthinvestors.com.au

5. Verse Wealth

Key Highlights: Holistic financial advice, multi-award-winning firm, and unbiased, commission-free advice with a focus on client outcomes.

It’s personalised, impactful, and multi-award-winning. It’s based on the understanding that your life and finances are inseparable, and money is just a resource to give you choices and help live the life you want – so your money is truly serving you, rather than the other way around. To learn more about their Approach, click here.

Holistic advice. The advice at Verse embraces your entire financial life, this includes strategy, investing, super, retirement planning, tax, trusts, cash flow, employee share schemes, debt management, property, insurance, and estate planning. To learn more about their Services, click here.

Verse operates with no commissions, no kickbacks, and no incentives to recommend financial products. To learn more about their clients, click here.

Some of their recent awards include:

- 2023 Financial Adviser of the Year – Women in Finance

- 2023 Female Excellence Award – Financial Advice Association Australia

- 2022 Goals Based Adviser of the Year – Independent Financial Advisers

- 2021 Excellence Award – Independent Financial Advisers

- 2021 Client Outcome of the Year – Independent Financial Advisers

- 2020 Advice Innovation Award – Financial Planning Association

- 2020 Client Servicing Adviser of the Year – Independent Financial Advisers

Verse offers a free 30-minute Introductory Chat on Zoom.

Address: Hub Southern Cross, 696 Bourke St, Melbourne VIC 3000

Email: admin@versewealth.com.au

Phone: 1300 822 165

Website: www.versewealth.com.au

6. Discover Financial Partners

Discover Financial Partners is a trusted Melbourne-based financial advisory firm dedicated to helping individuals and families achieve long-term financial wellbeing. With a client-first approach, they offer tailored strategies in wealth creation, retirement planning, superannuation, private wealth and investment management. Their experienced team combines deep industry knowledge with a genuine commitment to transparency and personalised service. Whether you’re planning for the future or navigating complex financial decisions, Discover Financial Partners provides clarity and confidence every step of the way. Their holistic advice empowers clients to make informed choices and build a secure financial future with peace of mind.

They offer a free 30 min no-obligation Discovery Meeting.

Address: Level 3, Building 5, 658 Church St, Richmond 3121 VIC

Email: info@discoverwealth.com.au

Phone: 03 9008 4660

Website: www.discoverfinancialpartners.com.au

7. Hewison Private Wealth

Key Highlights: Human-centered financial planning, over $1.7 billion managed, and multiple advisors listed in the Barron’s Top 100.

What sets Hewison apart is its commitment to making financial planning as human as possible. They seek to understand the inner workings of each client and tailor-fit strategies and plans to support that. That’s why in the last 37 years, the firm has managed over $1.7 billion worth of funds for its clients.

The firm has three financial advisors on the Barrons top 100 financial advisors list and several more in various business excellence awards.

Location: 8/417 St Kilda Rd, Melbourne VIC 3004, Australia

Phone: +61 3 8548 4800

Website: hewison.com.au

8. Pursue Wealth

Key Highlights: Specialises in lifestyle and retirement planning with personalised wealth management under strong leadership.

Pursue Wealth specialises in lifestyle planning, retirement planning, and education funding, among many of its other financial planning services. Led by Sam Robinson, the firm rests on the shoulder of a leader who cares for her team and clients individually. The firm holds a very personalised approach to wealth management and works to make each client feel comfortable and confident that their wealth and finances are in the right hands.

Location: Level 4/80 Market St, South Melbourne VIC 3205, Australia

Phone: +61 3 9686 1784

Website: pursuewealth.com.au

9. Rasiah Private Wealth Management

Key Highlights: Conflict-free financial advice based on integrity and excellence, with a focus on long-term client partnerships.

Beyond all else, Rasia Private Wealth Management is a financial institution stands on integrity, excellence, and ethics as its core values. The financial planning firm seeks to partner with its clients and promises to turn down all commissions and kickbacks to assure people in their community that they are getting financial advice without the blemish of any conflict of interest.

Location: Level 8/419 Collins St, Melbourne VIC 3000, Australia

Phone: +61 480 091 779

Website: rasiahprivate.com.au

10. Independent Wealth Partners

Key Highlights: Unbiased, conflict-free financial advice with a focus on achieving financial security and led by an award-winning planner.

Independent Wealth Partners stands on the belief that investment advice that brings financial success should be without any bias or conflict of interest. To achieve that conviction, the firm’s financial advisers are independent and receive no incentives apart from the work they do for clients.

The firm is run and led by Cameron Howlett, certified financial planner, DipFP, BBus/BComp, CFP™ SSA®, registered Tax Agent and IFA Magazine Investment’s Adviser of the Year in 2015 and SMSF Adviser of the Year in 2015 and 2016. Independent Wealth Planners helps its clients achieve financial security and financial independence by giving top-level advice on financial products that will help them reach their goals.

Location: Level 3/530 Collins St, Melbourne VIC 3000, Australia

Phone: +61 3 8393 9371

Website: independentwealthpartners.com.au

11. ActOn Wealth

Key Highlights: Bespoke financial advice, including mortgage broking and retirement planning, designed to exceed client goals.

ActOn Wealth loves looking after Melburnians to successfully build their financial wealth.

Their local firm knows that wherever you are in life, whatever your plans, you’re after bespoke financial advice that doesn’t just achieve your goals, it surpasses them. You want a dedicated wealth-building partner who understands you and where you want to go and then helps you get there on the most direct, friction-free path. ActOn Wealth is that partner.

But they’re also fully-qualified mortgage brokers, meaning they can provide comprehensive, independent advice that considers your complete financial situation. So for lending, budgeting and cash flow management, investments and insurance, superannuation and retirement planning, setting up your own SMSF or estate planning, touch base with their team about a no-cost, no-obligation meeting.

For a wealth-building strategy that sets you up for the life you want – today and tomorrow – contact ActOn Wealth.

Phone: 1300 022 866

Email: contactus@actonwealth.com.au

Location: 28/20 Commercial Rd, Melbourne VIC 3004

Website: www.actonwealth.com.au

Other Honourable Mentions

Before we wrap things up, here are some financial planners that deserve an honourable mention. We’ll study them a bit more and possibly expand this list soon!

- National Financial Planners Pty Ltd

- Endorphin Wealth

- Maddern Financial Advisers

- Flinders Wealth

- Toro Wealth Financial

- Kearney Group

Frequently Asked Questions (FAQs)

How much do financial planners charge in Melbourne?

Financial planners in Melbourne (and the rest of Australia) have various ways of charging their clients. They can charge you a flat or hourly rate, or a percentage of the assets they manage.

According to a 2021 study by AdvisoryHQ, the average cost of a basic financial plan is between $1,500 and $2,500. Ongoing financial advice and management cost between $4,000 and $6,000 on average.

Financial planner vs advisor— what’s the difference?

Financial planners and financial advisors are both financial professionals. Both offer guidance on investments, taxes, and other financial matters. However, they focus on different areas of a client’s finances and have different roles.

Financial planners generally focus on a client’s long-term financial goals and how to achieve them. Their work includes creating strategic plans for multiple areas of a client’s finances, such as tax planning, retirement planning, insurance protection, and life events. Financial planners often form ongoing relationships with clients.

Financial advisors have a less holistic focus. They manage a client’s investments in securities, and tend to focus on specific transactions and short-term situations. Advisors might also help with investments, saving for retirement, buying a home, business investments, insurance coverage, and estate planning. Financial advisors may come in for limited periods of time.

Is it worth paying for a financial advisor in Australia?

In more ways than one, hiring a financial advisor or planner can give you great value for money. Hiring one in Australia can help you reach your financial goals, especially if you have complicated finances or don’t have the time or knowledge to manage them yourself.

Financial advisors can help you with all sorts of things, including:

- Set goals

- Take advantage of tax breaks

- Invest wisely

- Navigate tax, investment, and superannuation rules

- Determine how well you’re progressing towards your goals

- Set more realistic goals if you’re not on track

- Put strategies in place

But as we normally do, we encourage you to take a look at your context and needs and make an informed decision. You can also speak to a few of the financial planners we mentioned above to ask what they do, their process, and what type of clients they serve best.

Final Words

While this list is non-exhaustive, and we believe there are many more financial planners out there you can trust, we’ve done our fair share of research and know that everyone on this list deserves your time and attention. So feel free to reach out to them if you need help reaching your financial objectives.

Do you know anyone else that should be on this list? Feel free to reach out and let us know!